Mergers and acquisitions (M&A) promise growth, new markets, and bigger opportunities. Yet most fail to deliver on expectations. In fact, the odds are stacked against success. In this first part of our series, we’ll explore why so many mergers don’t create new quality — and why “superiority” can quickly backfire.

Few Mergers Create New Quality

Experience shows that only few mergers and acquisitions produce new quality. In the past two decades, thousands of companies have joined in with the global trend of forming large multinational corporations through mergers and acquisitions. It is for many of them the only opportunity to succeed in the new current economic environment. But this crucial moment in a company’s life-cycle is rarely successful. According to statistics, only one third of all mergers and acquisitions bring expected results. And only few of them surprised stakeholders with unexpectedly good results.

Bearing in mind that the above-mentioned trend of the past decades is bound to continue, we should take a look at the most important recommendations that could help companies steer their way around the greatest mistakes and disappointments.

Five Different Situations

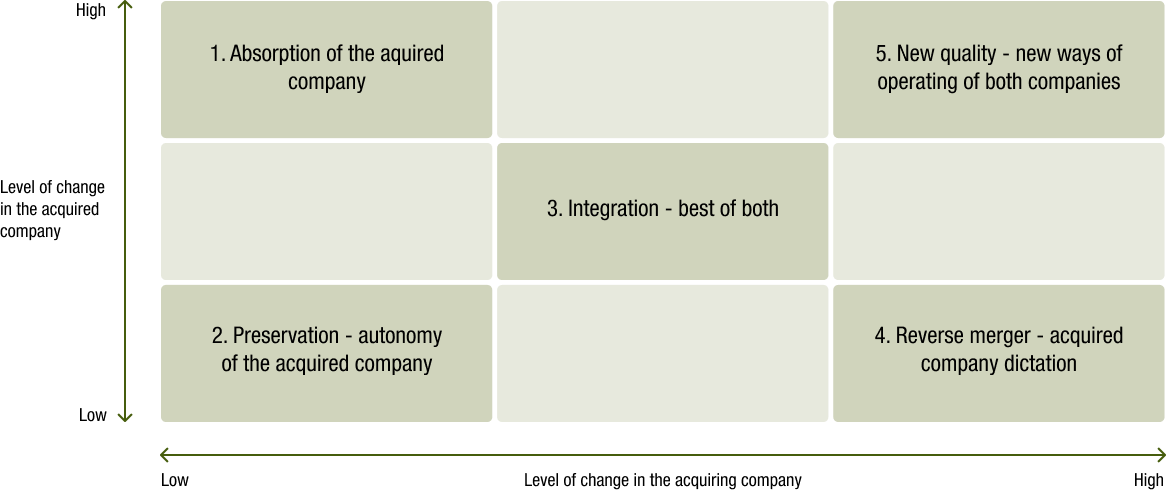

The first recommendation is to think about what the planned integration of two companies is meant to bring, what the business strategy and new corporate culture of the emerging company will be like. Five different situations can surface here, as illustrated in the table below.

The Flush of Victory – When 1 + 1 = 1

The most frequent situation is when a smaller business is swallowed up by a larger investor. Here we see the full integration of the two companies in a situation where the smaller outfit is temporarily or long-term controlled by the investor’s managers. Their main aim is to implement all the procedures and processes of the parent company and make sure the new corporate culture and business values are fully compliant with the investor’s culture.

The result of this situation is the equation 1 + 1 = 1. This occurs because the investor, or at least the managers representing the investor, cannot resist the intoxication of victory and the related arrogance. In a situation like this, the larger company cannot even imagine that the company it has bought can teach it or offer it anything. This gives rise to a high degree of frustration and demotivation, and is a great opportunity for the competition to strike. Rivals have a unique opportunity to lure a great many adept executives, specialists, and consequently customers on to their side. World statistics and analyses related to acquisitions show that up to 75% of fusions belong to this category.

Why 1 + 1 Rarely Equals 2

Only about ten percent of acquisitions focus on the target situation, i.e. the equation 1 + 1 = 2. Here both partners make contributions to the new company with the best they’ve got, especially in sales, production, or R&D. In order to achieve this goal, two conditions have to be met. The first is the existence of a communication, and decision-making strategy geared to the target right from the start.

This is not easy, because investors tend to use experts and consultants specializing in financial management, law, and corporate processes in the search for and research into suitable partners. These people are usually paid to find problems and weaknesses in the partner they are buying, and not for seeking out unusual and creative business opportunities. Their approach and information on the company that is to be the subject of acquisition create a negative impression and the feeling that everything has to be taken firmly in hand and changed quickly.

Another reason why so few acquisitions achieve the result 1 + 1 = 2 can be put down to emotions and the uncontrolled human factors connected to the integration on both sides. Confidential interviews with investors’ presidents and CEOs reveal that in many cases the main and final reason for the acquisition is their ego. The swift, highly visible conquest of a particular market or defeat of a rival produces an unrepeatable feeling of victory. And this is hardly the basis on which to build respect for the results of the minority partner, willingness to understand each other, and good teamwork.

Conclusion

Most mergers do not fail because of strategy on paper — they fail because of people. Superiority, arrogance, and a blind spot for culture turn potential into loss.

In Part 2, we’ll look at the rare but powerful situations where mergers actually create synergy: when 1 + 1 = 3.

Read Part 2: When 1 + 1 = 3 — Rare Success Stories

Richard Dobeš, Managing Partner, Top Partners International, s.r.o.

Richard Dobeš is an executive coach and leadership consultant with over 20 years of experience helping organisations, teams, and leaders grow.

He has held senior roles including CEO and Managing Partner at Top Partners International, and today advises international clients across industries on leadership, strategy, and organisational change.

Richard is also one of People & Performance’s Global Network Partners.